What Is Financial Aid?

After "Will I get in?" the next question that usually crosses a student’s minds is "How will I pay for it?" One answer might be financial aid. But what is financial aid? How do you qualify and apply for it? Do you have to pay back financial aid you receive? Here’s an overview of the basics.

The Types of Financial Aid Available

College financial aid comes in several forms: grants, scholarships, loans, and jobs. Some aid is "need-based," which means colleges award it solely based on your and your family's ability to pay for college. Other aid is "merit-based," which means colleges award it based on other factors, such as academic achievement or other accomplishments or talents.

Some Types of Financial Aid Reduce College Cost and Some Don't

Financial aid is also divided into two important categories: “gift aid” and “self-help aid.” What’s the difference? Only gift aid actually reduces your college cost because you don’t need to repay it. Self-help aid helps you pay for college using your own resources.

- Grants and scholarships are gift aid. Grants, which colleges usually award based on financial need, reduce your college bill dollar for dollar. Scholarships, which colleges award based on a wide range of criteria, also reduce your college bill dollar for dollar. Students do not need to pay back grants or scholarships.

- Loans and work-study are self-help aid. A student loan is money you borrow from the federal government or from a private financial institution to cover some of your college bill. You must eventually repay your college loans, plus interest. Work-study is a part-time job funded by the federal or state government to help students cover college costs. Because students must work to earn work-study money, it isn’t considered “gift aid”.

How to Qualify for Financial Aid Awards

You may qualify for college financial aid based on financial need, based on merit, or both.

- To qualify for aid based on financial need, you must prove that you and your family don't have enough financial resources to pay for college. Colleges award the lion's share of aid to students with financial need.

- To qualify for aid based on merit, you must show academic achievement, high test scores, extraordinary or unique talents or accomplishments. Financial need may be an additional factor.

How to Get Need-Based Aid

You and your family must submit your financial information to colleges via the government's Free Application for Federal Student Aid (FAFSA). Some colleges ask for an additional aid application called the CSS/Profile.

Using the information from one or both of these applications, colleges calculate your Expected Family Contribution (EFC), which is a metric colleges use to determine your financial need and how much aid you may be eligible for. Colleges calculate your financial need annually, so you will need to reapply for aid every year of college.

How to Get Merit-Based Aid

Colleges that offer merit aid generally offer it to students whose GPAs and test scores are well above average compared with their current freshmen class. But other factors, such as strength in the arts or sports, may also lead to awards. The application process may be as simple as checking a box on the admission application or may require filling out a separate application.

It's a good idea to familiarize yourself with a college’s financial aid policies as well as the merit scholarships they offer. Many colleges list merit scholarships on their website.

how much Finanical Aid Do colleges award?

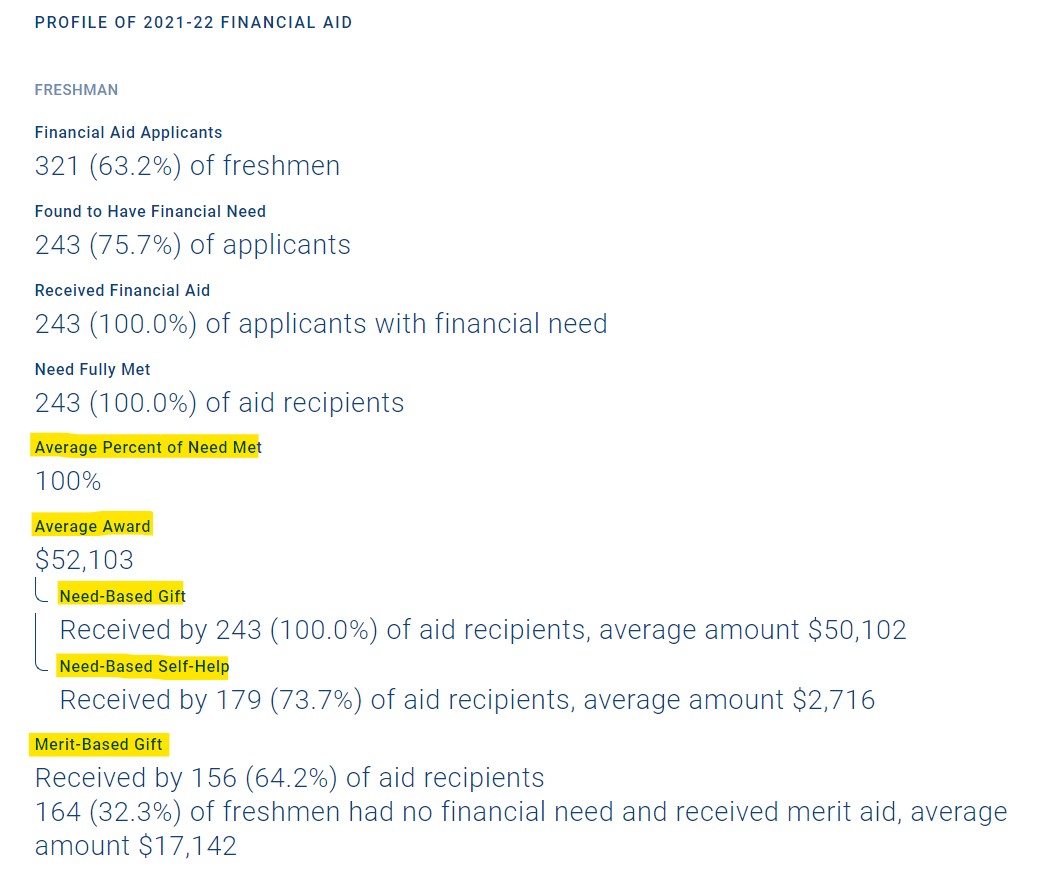

You can get an idea of how much a college awards in financial aid to students each year by viewing its CollegeData college profile, which you can access with College Search.

Image Source: Kenyon College Profile

In this example from the college profile for Kenyon College, you can see that in 2021-22, the college awarded an average total aid package of $52,103, consisting of $50,102 in need-based gift aid (scholarships and grants) and $2,716 in need-based self-help aid (loans and work-study), on average. The average merit-based scholarship Kenyon awarded to students without financial need was $17,142.

Learning as much as possible about financial aid is one of the most important things you can do as you apply to college. Understanding the different financial aid policies colleges follow can prevent you from applying to colleges that are financially out of reach or disregarding expensive colleges that, with the right combination of self-help and gift aid, you might be able to afford.

For more information on financial aid, see the articles in Pay Your Way.