What You Need to Know About Financial Need

Your "financial need" is not how much money you think you need for college. It is an official calculation that affects the size of your aid package.

Colleges consider your and your family’s “financial need” when deciding how much aid to award you. In financial aid lingo, your "financial need" is the difference between two important numbers: a college’s Cost of Attendance (COA) and your family’s Student Aid Index (SAI).

The greater the difference between your SAI and a college's COA, the greater your “financial need,” and the more financial aid you may be eligible for.

SAI, COA, and Financial Need Explained

Your financial need — and your financial aid eligibility — depends on your SAI and a college’s COA. Your SAI is calculated based on the information that you provide on the Free Application for Federal Student Aid (FAFSA) and represents your and your family's ability to contribute to a college education. It is not necessarily the exact amount you and your family will be required to pay for college, nor is it the amount of financial aid you will receive. Think of the SAI as a number that colleges will use to determine how much — and what types — of financial aid you might be eligible for.

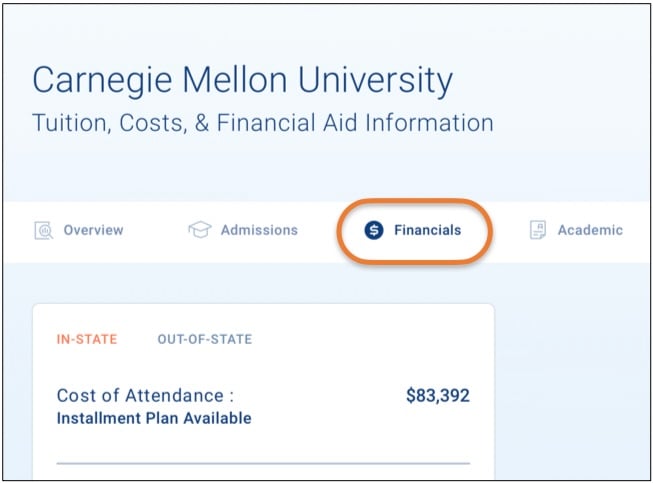

To calculate your financial need, colleges subtract your SAI from the their cost of attendance or COA. A college’s COA is an estimate of how much it costs to attend that college for one year, and it should be posted on the college's website. You can also find a college’s COA in its CollegeData college profile using College Search.

How Colleges Calculate Your Financial Need

Here’s an example of how college’s calculate financial need:

If College A’s COA is $40,000 and your SAI from the FAFSA is $10,000, your financial need to attend College A will be $30,000.

$40,000 (COA) - $10,000 (SAI) = $30,000 (Financial Need)

College B’s COA is $80,000. At College B, your financial need will be higher.

$80,000 (COA) - $10,000 (SAI) = $70,000 (Financial Need)

College A and College B will try to cover all or some of your financial need using a combination of loans, grants, scholarships and work-study.

How Financial Need Impacts Your Aid Offer

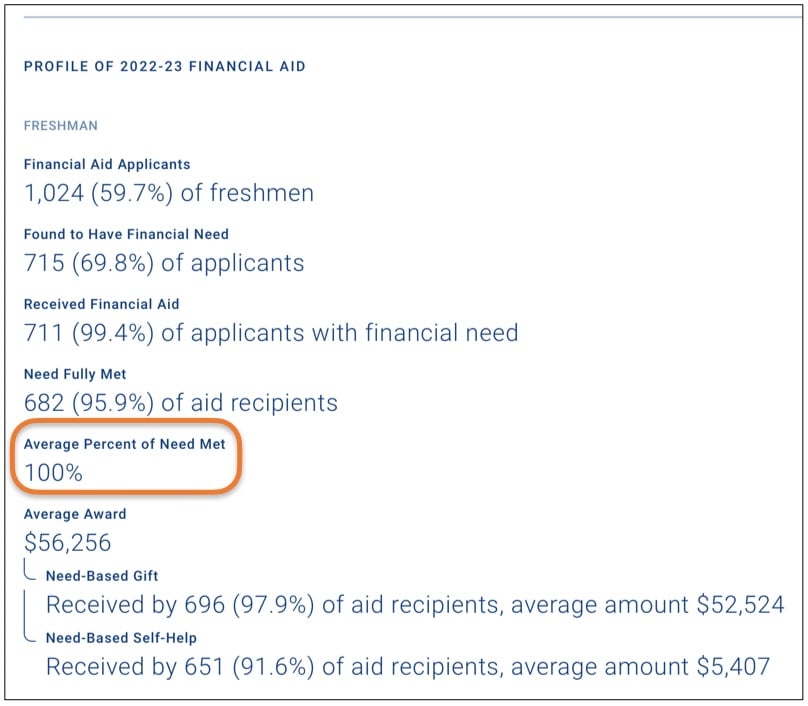

Some colleges meet 100 percent of a student’s financial need. But many colleges do not have the resources to do so, and instead meet only a percentage.

Using the previous example, if College A meets 100 percent of financial need, it would award our student an aid package totaling $30,000. Keep in mind, however, that this package may contain loans that the student needs to repay, as well as scholarships and grants which don't need to be repaid, and work-study. In addition, this student will still need to pay their SAI of $10,000.

If College A meets only a percentage of financial need, it might give this same student a total aid package of $20,000. The same student would need to pay $10,000 in SAI plus another $10,000 in unmet financial need.

How to find out how much financial need a college meets on CollegeData

You can look up how much financial need a college meets, on average, in CollegeData’s college profiles, which you can access using College Search.

In the college profile, select the “Financials” tab.

Scroll down the page to the “Profile of Financial Aid” section to find the “Average Percent of Need Met.”

OTHER WAYS COLLEGES CALCULATE FINANCIAL NEED

Colleges use your SAI from the FAFSA to determine your eligibility for different types of federal student aid. These include federal student loans, federal grants and work-study. Some colleges also award "institutional aid," which comes from the college's own funds. Many colleges use the FAFSA’s SAI to calculate your financial need for institutional aid, but some private colleges calculate a different SAI for this purpose. These colleges may ask you to complete another financial aid form called the CSS/Financial Aid Profile, which digs deeper into your financial picture. For example, it may ask you to provide information about the equity of a home your family owns, which the FAFSA does not take into account.

Familiarizing yourself with the concept of financial need — and how colleges use it to award financial aid — can help you anticipate your college costs, understand and compare your financial aid offers, and make a wise college choice.