Resources / Explore Your Options

How to Find Financially Friendly Colleges

Want to apply to schools likely to be affordable? Here's how to identify these "financially friendly" colleges.

The most generous college is not necessarily the one with the biggest financial aid package. It's the one that most reduces your college cost. Fortunately, on CollegeData you can identify colleges that provide cost-reducing financial aid by including important factors in your college search.

Search for Financially Friendly Colleges on CollegeData

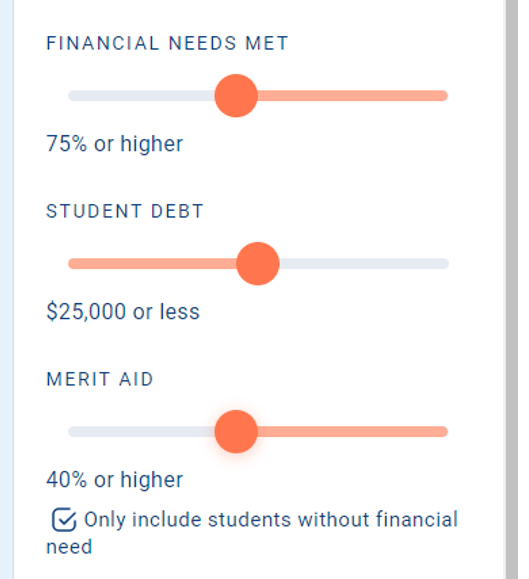

Use these Financial Friendliness search options on College Search to find colleges likely to offer cost-reducing aid packages.

- Financial Need Met. Search based on the average percent of financial need met for freshmen.

- Student Debt. Search based on the average debt burden of graduating seniors.

- Merit Aid Awarded. Search based on the percentage of freshmen (with and without financial need) who receive merit aid.

Look for financial friendliness data in the college profiles

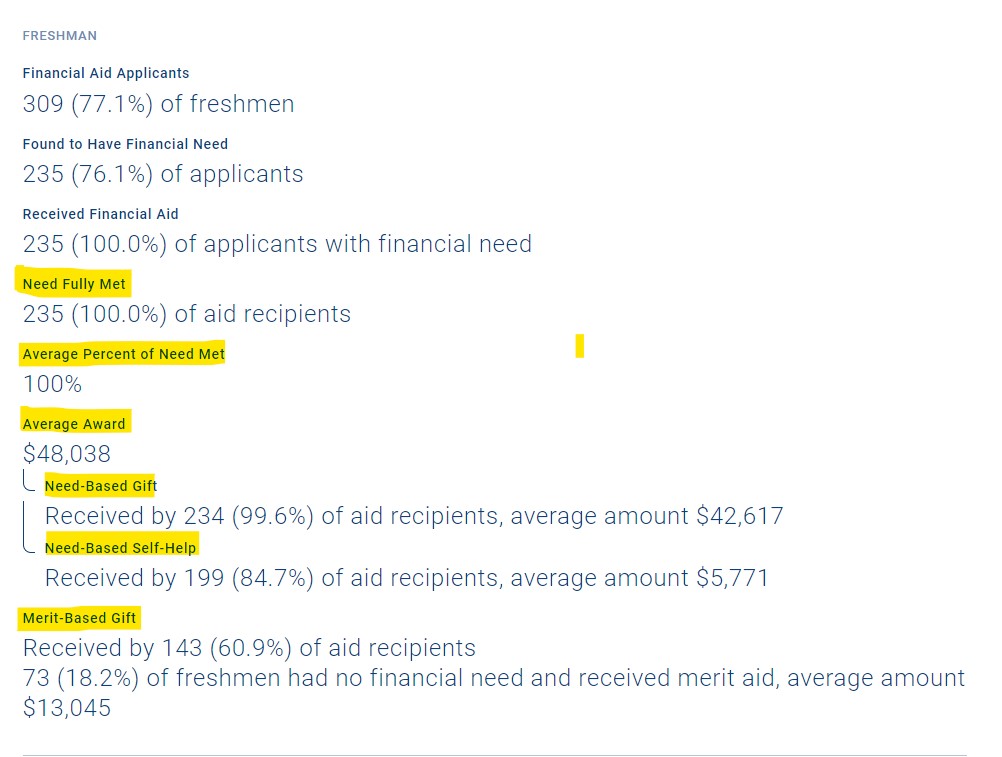

Every College Profile on CollegeData displays valuable information about financial aid offered to students. Look up these factors on the Financials tab:

-

Need Fully Met. Note the percentage of students who get their financial need fully met – some colleges meet 100 percent of a student’s financial need, but other colleges do not.

-

Gift aid. See the percentage of students who receive need-based and merit-based grants and scholarships, and how much. Grants and scholarships do not need to be repaid, so they reduce your college cost.

-

Self-help aid. See the percentage of students who receive loans and work-study awards and the average amounts of that aid. Some colleges don’t include loans in their aid packages; others provide mostly loans, which students need to repay. Loans do not reduce your college cost.

-

Debt. Note the average indebtedness of recent graduates.

-

Awards. See the number and types of non-need awards.

-

Time to graduate. Look for colleges with high four-year graduation rates. Nothing increases college cost more than needing an extra year or more to graduate.

-

Data for freshmen vs. data for all undergraduates. Compare the data for both groups. Some colleges reduce scholarships and grants after freshman year.

Be sure to review the top GPA and test scores of the most recent freshman class. The closer your stats are to theirs, the more likely you will be a top candidate for admission, and you may therefore have a better chance of receiving generous aid.

Look for Financial Friendliness Clues on College Websites

Search the college's website to uncover other factors that can impact aid packages.

- Outside scholarship policy. Colleges usually require students to report any scholarships or grants they receive from sources other than the college.The college will adjust your aid package according to its policies. Ideally, the collegewill reduce your unmet need and loans first, but some schools reduce gift aid, or a combination of both gift and need-based aid.

- Endowment level. Colleges with strong endowments may be more likely to offer generous "institutional aid," meaning aid that comes from their own resources.

- Loan policy. Some colleges limit or eliminate student loans.